Business

Effective Exposures: Is This Really Where You Want Your Money?

Kansas City, Missouri – Nick Newton

If we ever wondered if the world is flat, I think 2011 ended that speculation. The old adage is: when the United States sneezes, the rest of the world catches a cold. Well, I think it is fair to say, “We all live in the same house, and all of us caught the measles in 2011.” So, how do you prevent a repeat illness in 2012?

Assemble the Assets

Now is the time to pull out the 401(k) statements, the IRA statements, and the brokerage statements. Let’s take a look at our effective exposures. What do I mean? It is often the case that we view these individual accounts in isolation. For instance, our 401(k) has 70 percent stocks and 30 percent bonds. Our IRA or Roth IRA has a completely different allocation, and our brokerage account has yet a separate allocation. This is not to suggest there is anything wrong with your approach as long as it is intentional. That is effective exposure on a total portfolio. Ask yourself, “What in my total portfolio is or is not working?” If you are married, extend that thinking to your spouse’s portfolio to give you an idea of the total exposure of your home.

Maximize Your Money

Effective exposures is the quickest way to magnify gains or losses, more often losses. As we roll into the new year, it is always instructive to review the preceding year. We have discussed gearing your portfolio to take advantage of opportunities beyond our borders. If you find in your total portfolio you have too much home country bias (exposure to the United States), look abroad. The benefits of faster growing markets will pay big dividends in the future. So, check your exposures today. Make sure all of your allocations are intentional and get some overseas exposure.

-

Featured8 months ago

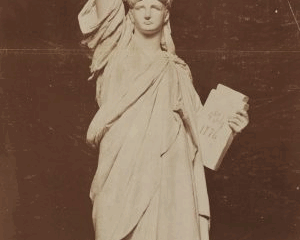

Featured8 months agoWhy the Statue of Liberty Sculptor Placed A Chain at Its Feet Instead of in the Left Hand

-

Featured7 months ago

Featured7 months agoA Whites-Only Community in Arkansas Draws Widespread Criticism

-

Featured11 months ago

Featured11 months agoTrump Signs Executive Orders That Will Impact HBCUs and Black Schoolchildren

-

Featured7 months ago

Featured7 months agoFirst, It Was Obama. Now Trump Lobs A False Claim At Beyonce to Shift Focus From Epstein.

-

Featured8 months ago

Featured8 months agoThe I.R.S. Moves to Allow Churches to Endorse Political Candidates, Ending A Decades-long Ban

-

Featured7 months ago

Featured7 months agoMeet Jolanda Jones and Borris Miles: Black Texas Lawmakers Fighting Redistricting